Key Takeaways:

- The SEC has taken a cautious approach to Ethereum ETF approvals, delaying decisions and first approving futures-based ETFs.

- Several major financial firms have filed for Ethereum ETFs, including Bitwise, VanEck, and Grayscale.

- Regulatory uncertainty around the classification of Ethereum as a security has created challenges for ETF applicants.

- The approval of the first Ethereum spot ETF could open the floodgates for more Ethereum-based investment products.

The US Securities and Exchange Commission (SEC) has sent back the S-1 filings to Ethereum ETF issuers on Friday with light comments. With this, the crypto industry is one step closer to having the spot Ethereum ETF approved. The issuers have been asked to address the comments and refile them by July 8. A total of eight asset managers, including prominent players like BlackRock and VanEck, are seeking regulatory clearance for Ethereum spot ETFs. Approval of the Ether spot ETFs would open the flood gates of investment for retail and institutional investors alike.

Related: SEC Clears Path for Spot Ethereum ETFs, Potential Launch as Early as July 2024

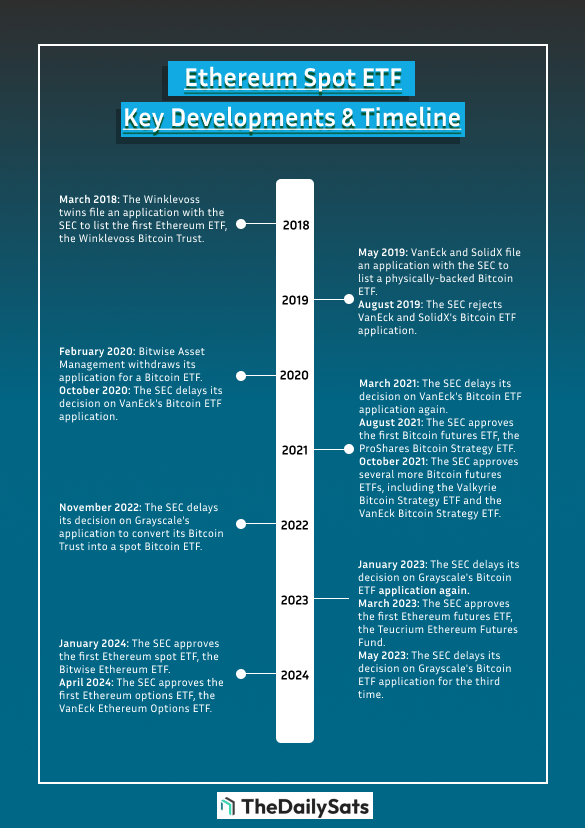

The Timeline of Ethereum ETF Developments

- March 2018: The Winklevoss twins submit an application for the first Ethereum ETF, the Winklevoss Bitcoin Trust.

- May 2019: VanEck and SolidX file an application for a physically-backed Bitcoin ETF.

- August 2019: The SEC rejects VanEck and SolidX’s Bitcoin ETF application.

- February 2020: Bitwise Asset Management withdraws its Bitcoin ETF application.

- October 2020: The SEC delays its decision on VanEck’s Bitcoin ETF application.

Sizing Ethereum ETF Flows & Potential Impact on Ether price

- Ethereum ETF inflows are projected to be 2-5 times lower than Bitcoin ETF inflows.

- ETH may be more price-sensitive to inflows due to supply dynamics.

- Factors like staking rewards and ETHE conversion could influence ETH ETF adoption.

- Overall, the launch of ETH ETFs is expected to have a positive impact on market adoption.

Read more: Ethereum ETF Inflows May Reach $5 Billion, Galaxy Report