Bitcoin (BTC) stands on the precipice of its next halving event, a historical moment often followed by significant price surges. This time, however, leading crypto asset manager Grayscale believes the impact might be even greater, citing strengthened fundamentals and evolving use cases as key differentiators.

Beyond Short-Term Challenges:

While short-term miner revenue faces uncertainties, Grayscale researcher Michael Zhao emphasizes the importance of “fundamental on-chain activity and positive market structure updates” that paint a different picture for Bitcoin’s future. He argues, “This halving is distinctly different on a fundamental level,” suggesting Bitcoin is transitioning into something “even more significant” than digital gold.

Why This Halving Could Be a Game Changer:

Halving Explained: Every four years, Bitcoin’s code halves the rewards for mining new blocks, reducing supply and historically triggering bull runs.

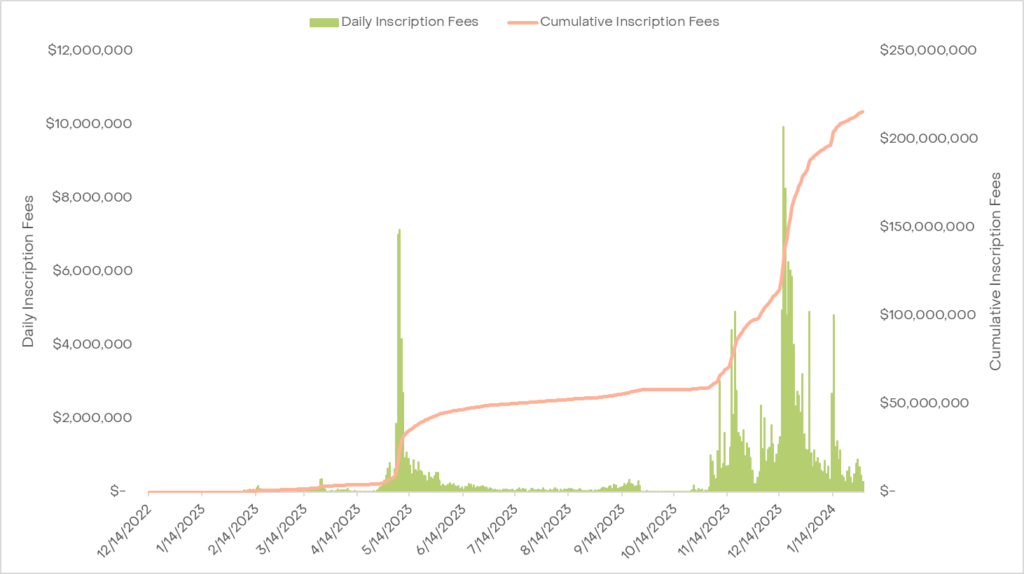

Enhanced Fundamentals: The emergence of Ordinals and BRC-20 tokens has revitalized on-chain activity, generating over $200 million in miner fees as of February 2024. This trend, fueled by renewed developer interest, is expected to continue.

Shifting Market Dynamics: Lower rewards post-halving require less buying pressure to maintain prices, potentially leading to higher prices due to increased demand. Currently, $14 billion in annual buying pressure is needed, which reduces to $7 billion after the halving, alleviating sell pressure.

ETF Boost: Spot Bitcoin ETFs, launched just a month ago, have already attracted billions from investors, creating additional buying pressure.

Breaking Down the Key Drivers:

Ordinals and BRC-20 Tokens: These innovations have breathed new life into Bitcoin’s network, driving on-chain activity and generating significant miner fees. They represent a paradigm shift in Bitcoin’s capabilities, showcasing its potential for expanding beyond just a store of value.

Shifting Market Dynamics: The reduced block rewards post-halving create a scenario where less buying pressure is needed to sustain prices. This, coupled with anticipated increased demand, could trigger a significant price upswing.

ETF Tailwinds: The recent launch of Spot Bitcoin ETFs has provided a new avenue for institutional investors to gain exposure to Bitcoin, injecting billions of dollars into the market and further fuelling potential price appreciation.

Beyond the Hype:

While Grayscale’s report paints a bullish picture, it’s crucial to acknowledge potential risks. Regulatory uncertainties, broader economic conditions, and unforeseen technical challenges could impact Bitcoin’s price trajectory. Therefore, thorough research and a well-defined investment strategy remain crucial for anyone considering entering the crypto market.

Conclusion:

Grayscale’s analysis suggests that Bitcoin’s upcoming halving could be a pivotal moment, driven by stronger fundamentals and evolving use cases. While potential risks exist, the report highlights compelling factors that could propel Bitcoin towards new highs. As always, investors should approach any cryptocurrency investment with caution and conduct their own due diligence.