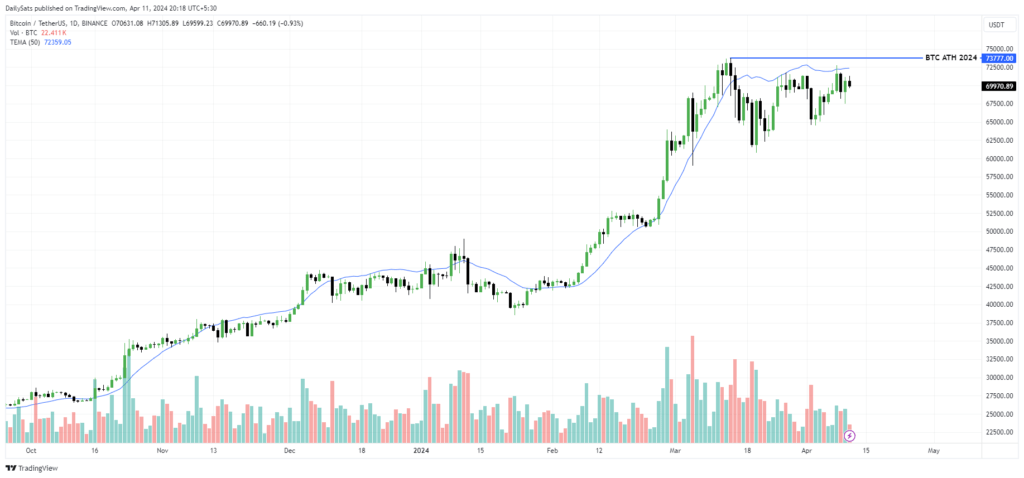

The events of the first quarter of 2024 have been particularly noteworthy, with Bitcoin price hitting new all-time highs against several fiat currencies.

The Approval of Spot Bitcoin ETFs

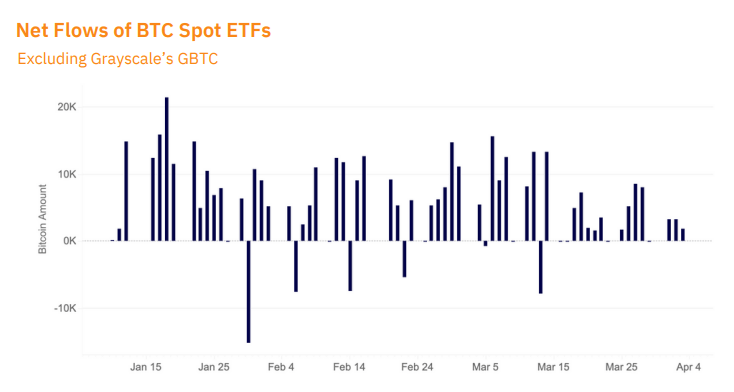

The journey began in January, when the long-awaited approval of 11 spot Bitcoin ETFs in the US sent shockwaves through the crypto market. Investors had been clamoring for these products for years, and their introduction proved to be a game-changer. The inflows into these new ETFs have been staggering, with over 51 out of 61 trading days in Q1 seeing net inflows. In fact, the ETFs have already become significant holders of Bitcoin, representing more than 4% of the total supply.

Leading the ETF Charge

Leading the charge are industry giants like BlackRock and Fidelity, whose Bitcoin ETFs have seen the largest net inflows. BlackRock’s IBIT fund, in particular, has made headlines by amassing over $10 billion in assets under management – the fastest any crypto ETF has reached this milestone.

Surging Trading Activity

But it’s not just the institutional money flowing into these ETFs that has fueled Bitcoin’s remarkable ascent. The approval of these products has also served to legitimize Bitcoin in the eyes of mainstream investors, who are now more comfortable allocating a portion of their portfolios to this burgeoning asset class.

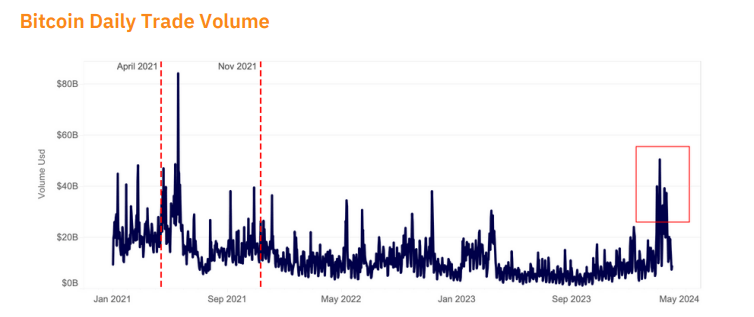

This newfound confidence has translated into a surge in trading activity, with Bitcoin spot volumes reaching multi-year highs on March 5th, surpassing the levels seen during the last all-time high in November 2021. The cumulative Bitcoin trading volume for the quarter totaled a staggering $1.4 trillion, the largest quarterly amount in over two years.

Shifting Exchange Dynamics

Interestingly, the distribution of this trading volume has shifted, with Binance seeing a sharp decline in its market share, dropping from 75% in Q1 2023 to just 48% in Q1 2024. This can be attributed to the end of the exchange’s large-scale zero-fee trading promotions, as well as a string of regulatory challenges that have impacted market sentiment. In their place, other offshore exchanges like Bybit and OKX have emerged as the primary beneficiaries, along with smaller APAC exchanges such as Bithumb, Korbit, Bitflyer, and Zaif.

Volatility Makes a Comeback

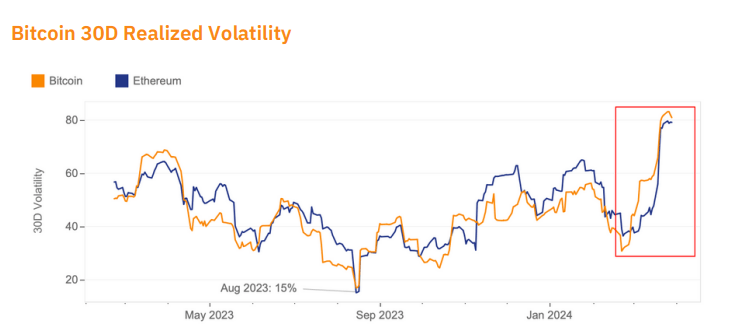

But the resurgence of Bitcoin has not been without its challenges. The increased trading activity has been accompanied by a corresponding rise in volatility, with Bitcoin’s 30-day realized volatility hitting a peak of 83% at the end of March – a level not seen since November 2022. This heightened volatility has contributed to a string of flash crashes, including one on Bitmex where the BTC-USDT price plummeted to $7,800, while trading at $66,000 on other platforms.

These flash crashes, driven by factors such as low liquidity and potential manipulation attempts, are a stark reminder that the crypto market is still prone to sudden and extreme price movements – a characteristic that sets it apart from traditional financial markets.

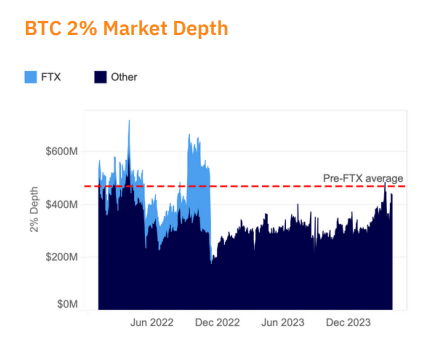

Filling the “Alameda Gap”

Despite these challenges, the overall picture remains positive. The “Alameda Gap” – the liquidity void left in the wake of the FTX and Alameda Research collapse – has largely been filled, with market depth recovering to pre-FTX levels. This has helped to reduce the cost of trading, as evidenced by the narrowing of bid-ask spreads on major US exchanges like Coinbase, Kraken, and Bitstamp.

Looking Ahead: Key Factors to Watch

As we move forward, I’ll be keeping a close eye on several key factors that could shape the future of Bitcoin’s trajectory. Chief among them will be the ongoing impact of spot ETF flows, which will undoubtedly continue to play a pivotal role in driving prices, both to the upside and the downside. Additionally, the market’s sensitivity to macroeconomic headwinds, such as the threat of persistent inflation and rising interest rates, will be crucial to monitor.

Renewed Optimism for the Crypto Industry

One thing is clear: the crypto industry has turned a new leaf, and Bitcoin’s resurgence in Q1 2024 has breathed fresh life into the market. As a seasoned observer, I can’t help but feel a renewed sense of excitement and optimism for the road ahead.