Should You Panic? Bitcoin Price Slump Sparks Record ETF Outflows

Key Takeaways:

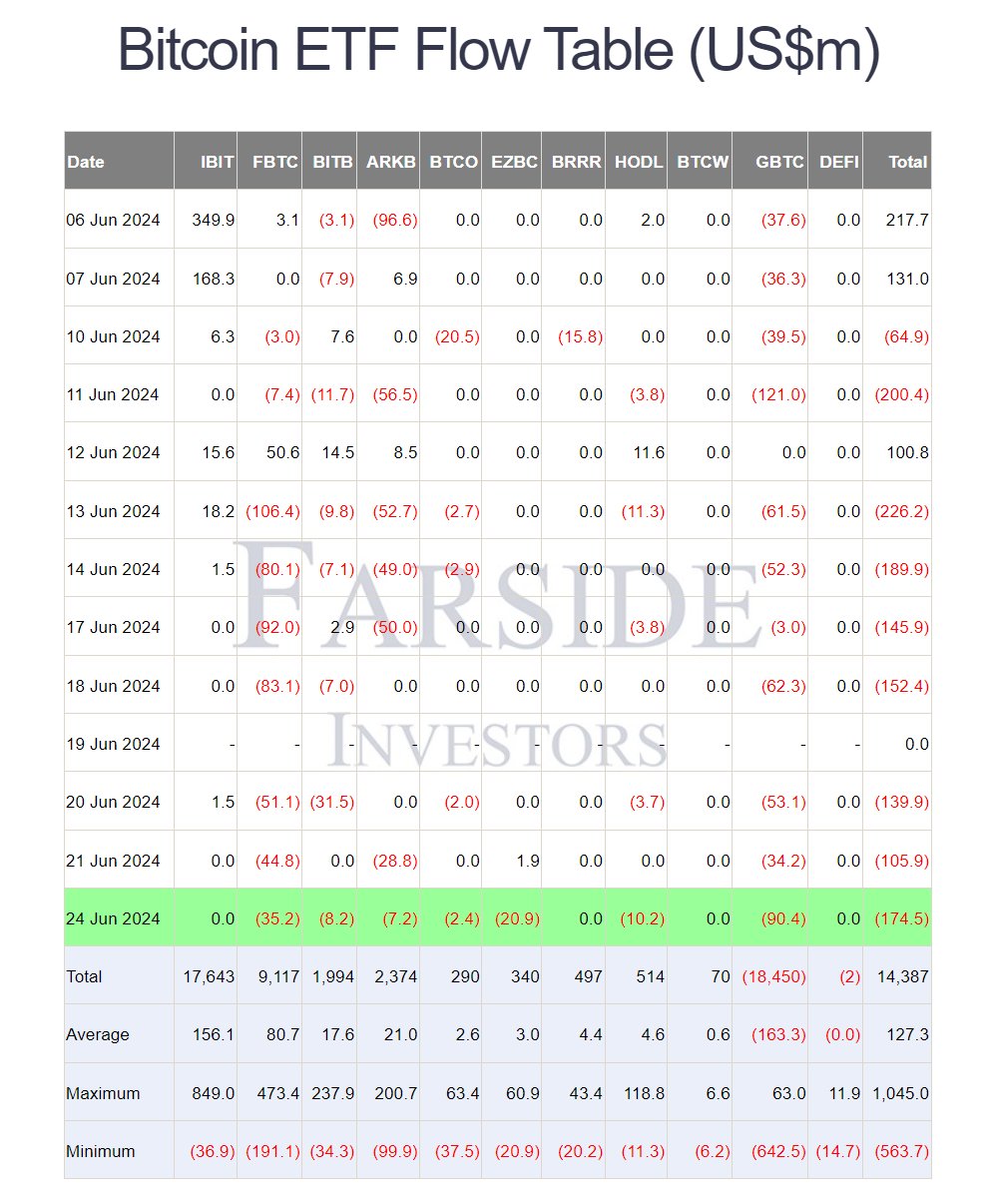

- U.S. spot Bitcoin ETFs experience record-tying seven days of net outflows, totaling over $1.1 billion.

- Bitcoin price dips below $60,000, potentially fueling investor fear and outflows.

- Analysts debate future Bitcoin price movements, with some predicting a rebound and others cautious.

Related: Bitcoin ETFs Hemorrhage $544 Million as Fed Hawkishness Bites Crypto

Bitcoin ETF Outflows Highlights Bearish Market Sentiment

U.S. spot Bitcoin exchange-traded funds (ETFs) are witnessing a significant exodus of investor capital, with seven consecutive days of net outflows mirroring a record set earlier in 2024. This recent flight from Bitcoin funds coincides with a notable decline in Bitcoin’s price, which briefly dipped below $60,000 on Monday.

Data compiled by Farside Investors reveals that the ten U.S. spot Bitcoin ETFs they track have shed a combined $1.1 billion over the past seven trading days, averaging a daily outflow of $162 million. Interestingly, Fidelity’s Wise Origin Bitcoin Fund (FBTC) has seen a larger capital flight than the previously leading Grayscale Bitcoin Trust (GBTC). However, a positive outlier exists: BlackRock’s iShares Bitcoin Trust (IBIT), the segment leader by assets under management, has managed to maintain slight inflows of approximately $21 million during this period.

This latest outflow streak aligns with a substantial drop in Bitcoin’s price. Analyst opinions diverge on the cause of the outflows. Some, referencing the April outflows, believe investors are taking profits after recent price gains. Others point to broader market concerns, including the upcoming Mt. Gox repayments, potential miner sell-offs, and the Federal Reserve’s decision to hold interest rates steady.

Despite the recent outflows, some analysts remain optimistic about Bitcoin’s future. They predict a potential rebound driven by factors like ongoing inflation, a possible Fed rate cut, and continued institutional adoption of Bitcoin. The upcoming U.S. elections in November are also seen as a potential catalyst, with the winner’s policies influencing market sentiment.

Related: Green Light for Ethereum ETFs: Altcoin ETF on Horizon?

The recent outflows from Bitcoin ETFs highlight investor uncertainty surrounding the cryptocurrency’s short-term trajectory. While some remain bullish on Bitcoin’s long-term prospects, near-term price movements hinge on upcoming events and broader economic forces.