- The US SEC has delayed the Hashdex and Grayscale Ethereum spot ETFs.

- Ethereum price could be forming a local top according to veteran trader Peter Brandt.

- The trader suggests that ETH could first head to $1,000 and then $650.

Ethereum price could tank in the near future as the US SEC delays spot Ethereum ETF filed by Grayscale and Hashdex.

More ETF News: Bitcoin Price Prediction Dec 16, 2023: ETF approval could attract $30 trillion as BTC looks to slide lower

Ethereum ETF hits another blockade

According to Reuters,the US Securities and Exchange Commission (SEC) has announced a postponement in its decision regarding the Grayscale Ethereum Futures Trust ETF. This filing, made on December 18, places Grayscale among several companies facing delays or rejections from the leading US regulatory body.

Coinbase Global also experienced a setback last week when the SEC denied its petition, requesting new regulatory guidelines for the digital asset sector. Following the denial, Coinbase took the initiative to file a petition for a court review of the SEC’s decision.

Adding to the developments, the SEC has deferred the evaluation of Hashdex’s Ethereum ETF, as indicated in a separate filing on Monday. Stay tuned for further updates on these regulatory proceedings.

Ethereum Price Prediction Dec 19: ETH could crash soon, Peter Brandt

According to Peter Brandt, the veteran stock market trader, Ethereum price is consolidating inside a wedge formation. If ETH “complies with the script,” says Brandt, the “target is $1,000.”

A breakdown of this key psychological level would send Ethereum price spiralling to the Brandt’s next target of $650.

More ETF News: Valkyrie Amends Spot Bitcoin ETF Filing: Latest Update in Prospectus Submitted to US SEC

Ethereum Long-term Forecast: BlackRock’s ETF Approval Nears

Bitcoin, the leading cryptocurrency, has surpassed the $40,000 mark for the first time since early 2022. This significant price hike is attributed to a groundbreaking move by BlackRock, which has not only fueled Bitcoin’s ascent but has also had a ripple effect on the broader crypto market, including major altcoins like Ethereum and XRP.

As the crypto community speculates about a potential “secret sovereign bitcoin bid,” BlackRock’s strategic adjustments to its Bitcoin ETF filing have become a focal point. The amendment allows major Wall Street institutions, including JPMorgan and Goldman Sachs, to serve as “authorized participants.” This key development aims to grant these financial giants access to the crypto market, marking a paradigm shift in institutional involvement.

Ethereum Price Targets Skyrocket Amid BlackRock’s Bitcoin ETF Developments

The second wave of excitement in the cryptocurrency space revolves around Ethereum’s potential price targets following BlackRock’s Bitcoin ETF developments. Ethereum (ETH), as the second-largest cryptocurrency, is poised for significant market shifts based on the implications of BlackRock’s strategic moves.

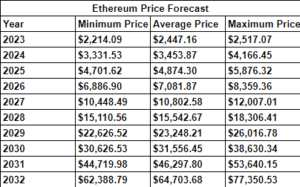

Changelly provided a detailed projection of Ethereum prices post-approval of BlackRock’s Bitcoin ETF. According to their analysis:

While emphasizing the inherent differences between Bitcoin and Ethereum, analysts believe that BlackRock’s Bitcoin ETF approval could set the stage for Ethereum’s remarkable growth. Ethereum investors and enthusiasts are closely monitoring the potential for institutional adoption and its transformative effects on the market in 2024.