Bitcoin (BTC) investors are on tenterhooks as the Federal Reserve prepares to deliver its latest policy decision. This announcement, particularly the projections for future interest rates, could significantly impact the price of Bitcoin. Let’s delve into the key factors influencing Bitcoin’s price in the current macroeconomic climate, analyze the implications of the Fed’s policy decisions, and explore the potential impact on spot Bitcoin exchange-traded funds (ETFs).

Related: Bitcoin Price Prediction: BTC monthly close below this level would be catastrophic

Key Takeaways

- Macroeconomic headwinds: Inflation, the war in Ukraine, and potential for sustained higher interest rates are creating uncertainty in the cryptocurrency market.

- Fed policy impact: The Fed’s policy decision and the dot plot projections for future interest rates could significantly influence Bitcoin’s price. A hawkish stance could dampen investor enthusiasm.

- Spot Bitcoin ETF outflows: Recent outflows from Grayscale’s GBTC raise concerns about waning investor appetite for spot Bitcoin ETFs. Higher fees and declining Bitcoin price might be contributing factors.

- Volatility ahead: Experts anticipate continued volatility in the crypto market due to the delicate economic balancing act by central banks.

- Long-term Bitcoin outlook: Mainstream adoption, regulatory clarity, and blockchain advancements could contribute to sustained Bitcoin growth, but the market remains young and susceptible to unforeseen events.

Understanding the Macroeconomic Landscape

The health of the global economy is intricately linked to the performance of Bitcoin and other cryptocurrencies. Currently, several macroeconomic headwinds are creating uncertainty in the market. Inflation remains a persistent concern, with central banks around the world grappling to rein it in without stifling economic growth. The ongoing war in Ukraine has further exacerbated supply chain disruptions and energy price volatility, adding to inflationary pressures.

The Fed and the Interest Rate Factor

The Federal Reserve’s monetary policy decisions have a profound influence on the financial markets, including the cryptocurrency space. Traditionally, lower interest rates tend to favor riskier assets like Bitcoin, as they incentivize investors to seek higher returns. Conversely, rising interest rates make these assets less attractive, potentially leading to price declines.

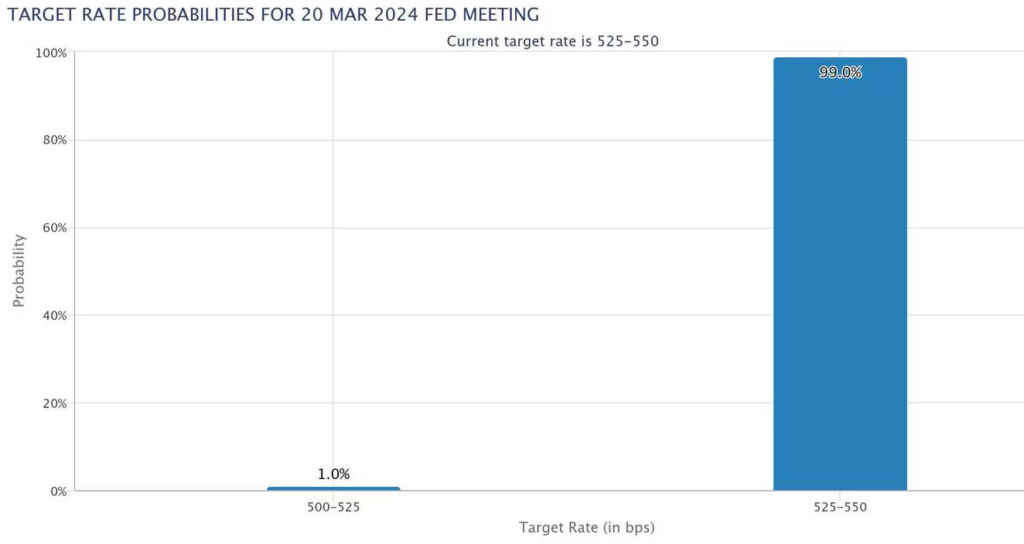

In the current scenario, the Fed is expected to maintain its current stance of keeping interest rates steady in the 5.25% to 5.5% range. However, the longer-term projections from the Federal Open Market Committee (FOMC) – illustrated in the dot plot – are likely to signal the potential for rates to stay elevated for a more extended period. This hawkish tilt from the Fed could dampen investor enthusiasm for Bitcoin and other cryptocurrencies.

The Importance of Spot Bitcoin ETFs

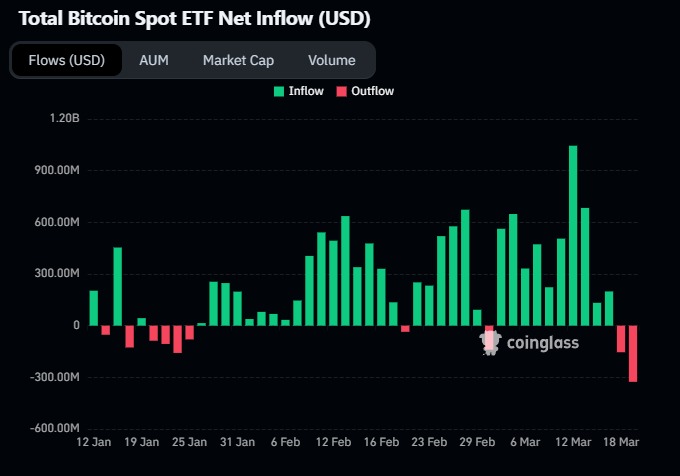

The emergence of spot Bitcoin ETFs has been a significant development for the cryptocurrency market. These exchange-traded funds allow investors to gain exposure to Bitcoin’s price movements without the complexities of directly owning and storing the digital asset. The recent outflows from Grayscale’s Bitcoin Investment Trust (GBTC) – the world’s largest Bitcoin fund – however, raise concerns about waning investor appetite for spot Bitcoin ETFs.

Several factors could be contributing to these outflows. Grayscale’s GBTC charges relatively high fees compared to its peers, potentially deterring some investors. Additionally, the recent decline in Bitcoin’s price might be prompting investors to take profits or reallocate their holdings to other assets.

Bitcoin Price Dip Coincides with Spot ETF Outflows

Bitcoin’s recent price decline comes alongside significant outflows from new spot Bitcoin exchange-traded funds (ETFs). Here’s a breakdown of the key data points:

- Bitcoin price: Down 16% from its all-time high of $73,800, reaching a low of $60,760 before recovering to around $63,000.

- Spot Bitcoin ETF outflows: Nearly $500 million withdrawn in the past two days, according to CoinShares.

- Grayscale outflows: Over $1 billion withdrawn from Grayscale’s Bitcoin Investment Trust this week, the largest outflow from a single fund.

Possible explanations for the outflows:

- Grayscale’s higher fees: Compared to competitors like BlackRock and Fidelity, Grayscale’s 1.5% fee might be deterring investors.

- Profit-taking: The recent price decline might be prompting some investors to take profits.

- Shift towards lower-fee competitors: Investors might be moving their money to ETFs with lower or waived fees to maximize returns.

Important to note:

- BlackRock’s iShares Bitcoin Trust, with its competitive fee structure, has seen inflows of $527 million this week.

- This price correction might be temporary, as some analysts believe it’s not indicative of a broader Bitcoin market collapse.

Volatility: The Name of the Game

Looking ahead, experts anticipate continued volatility in the crypto market. The delicate balancing act by central banks to control inflation without hindering economic growth will likely lead to fluctuations in risk asset prices. Bitcoin’s price is likely to remain susceptible to these broader market movements.

The Future of Bitcoin: A Speculative Outlook

While the short-term future of Bitcoin remains uncertain, the long-term outlook depends on several factors. Continued mainstream adoption, regulatory clarity, and advancements in blockchain technology could all contribute to Bitcoin’s sustained growth. However, the cryptocurrency market is still in its nascent stages, and unforeseen events could significantly impact its trajectory.