How the Halving Could Impact Bitcoin

Bitcoin halvings have generally been good for the network. But price increases have decreased over time.

Related: Demystifying the Bitcoin Halving: A Deep Dive into its Impact and Future

Key Points:

- Bitcoin halvings reduce rewards for miners, aiming to maintain scarcity and potentially drive price increases.

- While historically positive for price, the magnitude of these increases may diminish with each halving.

- Distribution of returns has narrowed as Bitcoin matures, suggesting lower future gains compared to early years.

- Miners face profitability challenges due to reduced rewards, leading to potential consolidation in the industry.

- Future mining will rely on transaction fees, requiring adaptation from miners.

- Bitcoin has evolved from a niche hobby to a regulated asset with its own ETFs, but volatility has decreased.

- Investors should avoid basing expectations solely on past halving cycles due to market maturation and different investor profiles.

The buzz surrounding Bitcoin’s upcoming halving event is undeniable. But for savvy investors, the key question remains: will history repeat itself with another price surge? This article delves deeper, analyzing the potential impact of the halving on price, miners, and the entire Bitcoin ecosystem.

Scarcity Meets Supply, Price Responds (But Not Always)

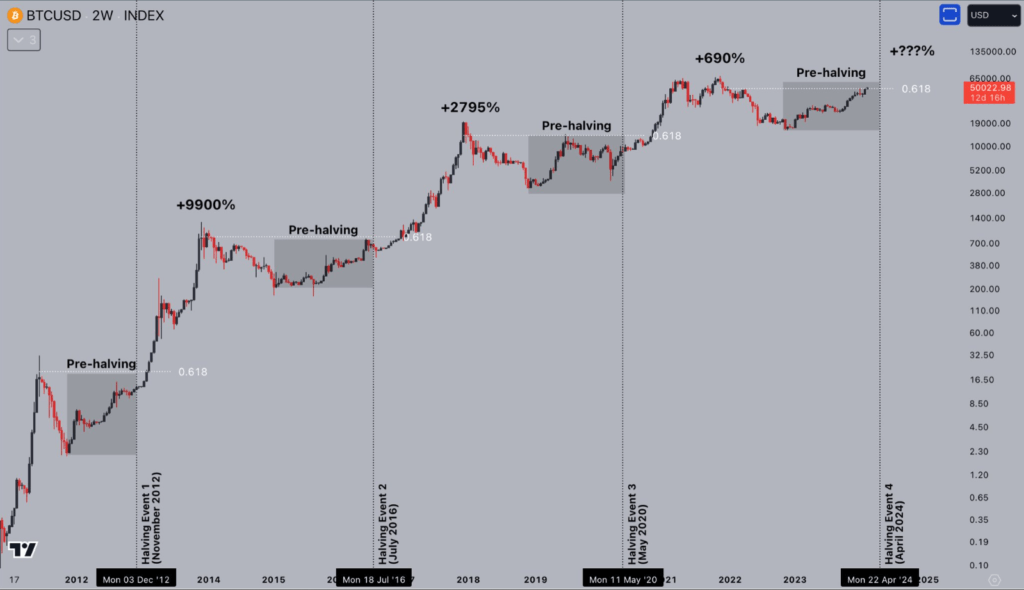

Bitcoin’s halving, occurring roughly every four years, reduces the block reward earned by miners by half, aiming to maintain scarcity. This has historically been associated with price increases, fueled by factors like reduced supply and increased investor interest. However, the magnitude of these increases may diminish with each halving.

Past Performance Isn’t a Crystal Ball: Expecting Similar Gains Might Be Unrealistic

While past halvings brought significant returns, the Bitcoin market has matured substantially. The distribution of returns has narrowed, indicating lower potential gains compared to the early years. Investors should adjust their expectations accordingly, understanding that the market dynamics and investor profiles have significantly changed.

Miners Feel the Pinch: Consolidation Looms

Miners, directly impacted by the reward reduction, face profitability challenges. This could lead to consolidation within the industry, with smaller players struggling to compete against larger miners with economies of scale and cheaper energy sources. Looking beyond halvings, miners will eventually transition to relying solely on transaction fees, necessitating further adaptation.

Beyond Price: The Halving’s Wider Impact

The halving’s influence extends beyond price. It highlights Bitcoin’s evolution from a niche hobby to a regulated asset with its own ETFs and derivatives markets. However, this evolution comes with decreased volatility, a factor investors should consider when formulating their expectations.

Navigating the Evolving Landscape: Knowledge is Key

While the exact impact of the halving remains uncertain, one thing is clear: Bitcoin and its surrounding ecosystem are constantly evolving. Investors should stay informed about these changes, adapt their expectations based on market realities, and avoid relying solely on past performance predictions. By understanding the nuances of the halving and its potential effects, investors can make informed decisions and navigate the ever-changing Bitcoin landscape with confidence.

Related: Grayscale Report Summary: Bitcoin Poised for Post-Halving Boom?

Bitcoin halving effect on price

The upcoming Bitcoin halving in April 2024 has analysts buzzing, but one chart is raising eyebrows for a reason unlike any previous halving. For the first time ever, the price of Bitcoin has surpassed the 0.618 Fibonacci retracement level before the halving event. This key technical indicator, often used to predict future trends, typically sees Bitcoin cross this level after the halving, marking the start of a bull run. So, what makes this halving potentially different?

Early Strength: A Sign of Things to Come?

Traditionally, halvings have triggered significant price increases due to the reduced supply of new Bitcoins entering circulation. However, the early breach of the 0.618 level suggests this bull run might be starting with unprecedented momentum. This could be attributed to several factors:

- Increased institutional adoption: The launch of Bitcoin ETFs has exposed the asset to a wider audience, potentially bringing in new buyers and driving up demand.

- Anticipation building: With the halving event approaching, excitement and speculation are likely fueling buying pressure from experienced investors.

- Technical confluence: The 0.618 level adds technical weight to the bullish sentiment, potentially attracting more technical traders who follow Fibonacci retracements.

While the exact impact of the halving remains uncertain, one thing is clear: this Bitcoin halving has unique characteristics that could signal a different kind of bull run compared to the past. By staying informed, considering diverse perspectives, and practicing responsible investing, you can navigate this potentially exciting chapter in Bitcoin’s journey.

Bitcoin Fourth Halving Countdown

Predicted Bitcoin Fourth Halving Date: April 20, 2024, 23:25:33 UTC