- Ripple price has entered the one-hour range and hints at a potential short-term reversal.

- XRP bulls could kickstart a 10% bounce if it can overcome the one-hour resistance level at $0.607 into a support level.

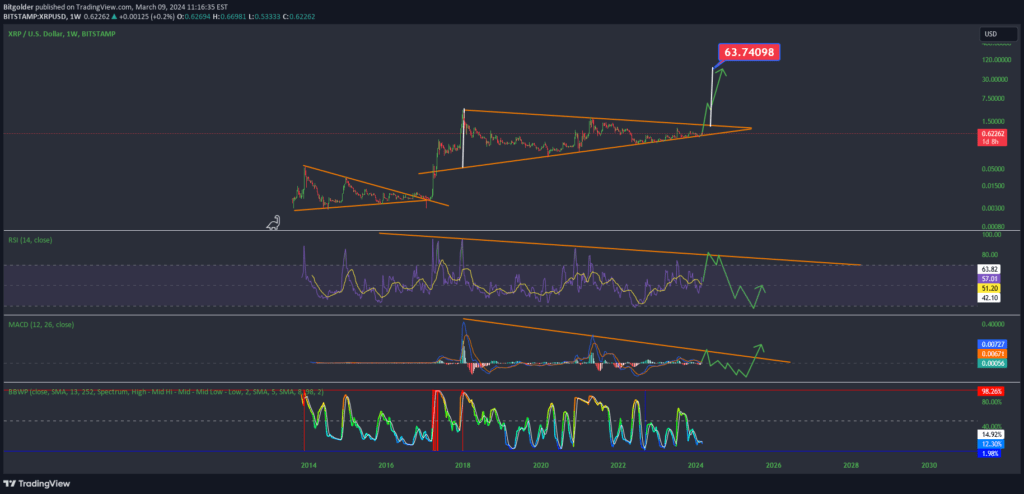

- Long-term projections aim for retesting $3.84 ATH by 2027-28, anticipating substantial growth.

Ripple price (XRP) has been underperforming compared to other major cryptocurrencies in the recent bull market. While some analysts view this as a sign of weakness, others see it as an opportunity for a more explosive breakout in the future.

Ripple Price Prediction March 20, 2023

- BBWP (Bollinger Bandwidth Percentage): This volatility indicator is starting to rise, suggesting increasing volatility for XRP. However, it remains relatively low compared to historical levels. The measured move based on the Bollinger Bands could be around $50.

- RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence): These momentum indicators suggest that XRP may be losing steam compared to other cryptocurrencies.

Potential Catalysts for a Bullish Breakout:

- Adoption by Banks: If major banks adopt XRP for cross-border payments, it could significantly increase demand and drive up the price.

- Fear of Missing Out (FOMO): A surge in mainstream adoption of cryptocurrencies could lead to FOMO buying, pushing the price of XRP higher.

Can Ripple price reach its all-time high?

Changelly, a prominent cryptocurrency platform, offers insights and a timeline into Ripple price reclaiming its all-time high. Expressing bullish sentiments on XRP price, the platform foresees a gradual ascent in its price, projecting a potential peak of $0.72 by the end of the current month.

However, the platform’s forecasts suggest that the journey toward retesting the $3.84 ATH might extend into the years 2027 to 2028. In this scenario, Changelly envisions XRP reaching a minimum price of $2.88 in 2027, a maximum of $3.49, and an average of $2.96. By 2028, the platform speculates that XRP could establish a definitive support level at the elusive $3.84 price point. Looking further into the future, Changelly anticipates an impressive average price of $19.38 for XRP by the year 2032, signifying an extraordinary 2,992.8% growth from its current valuation.

Beyond price predictions, the strength of XRP lies in its expanding utility and a growing ecosystem. Acknowledging its legal status in the United States, experts foresee XRP becoming a pivotal asset in the payment and remittance ecosystem. The strategic collaboration between Ripple and Uphold serves as a tangible illustration of businesses aligning with this prospective future.

As XRP charts its trajectory, the Changelly projections offer a glimpse into the coin’s potential in the long term. While challenges persist in regaining previous price highs, the coin’s growing utility and ecosystem expansion position it as a noteworthy player in the broader cryptocurrency landscape. The XRP community eagerly awaits the unfolding chapters in its journey, navigating the complexities of legal validation and market dynamics.

SEC vs. Ripple Lawsuit Update: Key Deadlines Approaching

- Ripple’s Response Due: April 23rd marks the deadline for Ripple to submit its official response to the SEC’s lawsuit regarding XRP. This response will address the legal arguments presented by the SEC.

- Public vs. Confidential Information: Two versions of Ripple’s response will be filed. One version will be made public on April 24th, while a redacted version excluding confidential business information will also be submitted. This aims to protect trade secrets and sensitive data.

- SEC Reply and Redaction: The SEC has until May 7th to file its response to Ripple’s arguments. Similar to Ripple’s response, a public version will be available on May 8th, with confidential details redacted.

- Remedies Phase Confidentiality: Both parties have agreed to request confidentiality for documents related to the “remedies” phase of the case. This phase focuses on potential consequences for Ripple if the court rules against them. The deadline for submitting these documents is May 13th.

- Public Objection Window: The public has until May 20th to object to the request to keep “remedies” phase documents confidential.

These deadlines signal significant progress in the SEC vs. Ripple lawsuit. The nature of Ripple’s response and the SEC’s counter-arguments will be crucial in determining the future of XRP.