As Bitcoin continues its stratospheric ascent, all eyes are glued to Coinbase (COIN) poised to report Q4 earnings today. With the recent launch of Bitcoin ETFs in the US sending shockwaves through the market, one question burns bright: will Coinbase emerge as the king of the castle, or will the winds of change sweep it away?

Further Reading: Navigating the Unique Bitcoin Halving with Technical Insights

Bitcoin’s Blistering Rally:

Imagine Bitcoin as a digital phoenix, rising from the ashes of skepticism to soar on the wings of scarcity. Its limited supply has fueled a 17% price surge in mere weeks, sending ripples of jubilation through the cryptoverse. And who stands to benefit most from this golden tide? Crypto companies like Coinbase, of course, their sails billowing with the winds of opportunity.

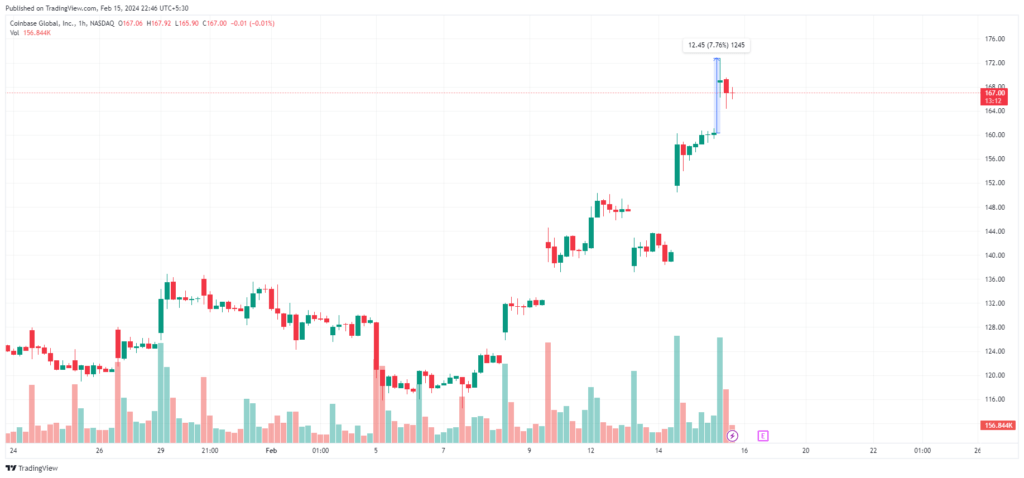

Coinbase price rallied 7.78% after the stock market opened today.

Coinbase: Guardian of the Digital Vault:

Coinbase plays a crucial role in this drama, acting as the secure vault for the Bitcoin held by these new ETFs. Imagine them as the Fort Knox of the digital age, charging hefty fees for their safeguarding services. However, a cunning plot unfolds: some ETF issuers are offering discounts to attract investors, potentially putting a dent in Coinbase’s immediate earnings.

As the market closes today, the tension thickens. Coinbase prepares to unveil its Q4 earnings, revealing whether the Bitcoin boom and ETF launch have translated into resounding success. Will the company bask in the golden glow of prosperity, or will the fee war cast a shadow on its earnings? Stay tuned, for the earnings call promises to be a nail-biting affair!